QUESTO PER FAR CAPIRE CHE SOLO GLI STUPIDI CREDONO ALLE STRONZATE MAINSTREAM DI CHI LI VUOLE FESSI ED INCHIAPPETTATI DA PAURE INESISTENTI, UN ESEMPIO DEL GENERE OVVERO IL LAVAGGIO DI DENARO DEI PROVENTI DELLA DROGA DA PARTE DI GRANDI ORGANI BANCARI MOSTRA PURTROPPO (E DIREI FORTUNATAMENTE PER CHI NON FA QUESTE COSE MA SOLO VUOLE LA GIUSTA PRIVACY FINANZIARIA CHE TUTTI CI MERITIAMO) CHE LA PRIVACY OFFSHORE ESISTE ED E MANTENUTA BELLA FORTE E CHE CERTE LEGGI CHE SERVONO A CONTRASTARLA IN REALTà SONO UTILI SOLO PER DISSANGUARE GLI ONESTI CITTADINI ,CHE A MIO PARERE SONO PURE UN PO FESSI, DI TASSE E BALZELLI NECESSARI A RENDERLI SEMPRE PIU SCHIAVI DI QUESTA STUPIDA SOCIETà.

SOTTO IL TESTO MACCHERONICAMENTE TRADOTTO

Financial Privacy and the Laundering of Drug Money

By James Hall

Global Research, June 18, 2014

BATR

The Foreign Account Tax Compliance Act, is the latest government effort to eliminate financial privacy from the international banking system. Already provisioned within the law are reporting requirements and penalties, so the intent of this regulation requisite, seems more intent on closing down foreign bank relations for American citizens.

As FATCA Comes Online July 1, 2014, most foreign banks will be under the gun to make inquires of their customers.

If you answer yes to any one of the above questions, some banks will immediately close your account and forwarded on the balance to you and other banks sent W-8BEN and/or W-9 IRS forms for completion and mailing back to the bank upon which a possible 30% U.S. tax withholding would be levied upon your accounts.

The underlying drive to discover the actual ownership of enterprises and their fiduciary principals are the focus in the article, FATCA’s crucial sidekick, the hunt for ‘beneficial owner’.

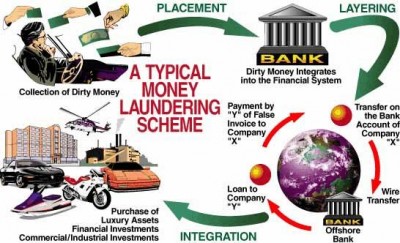

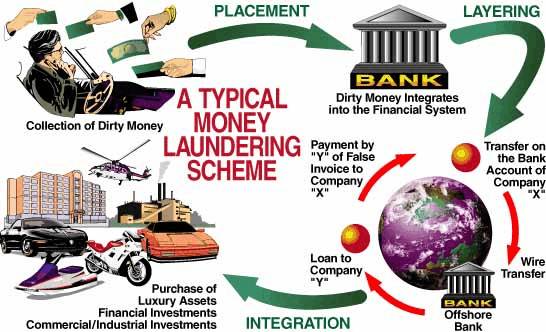

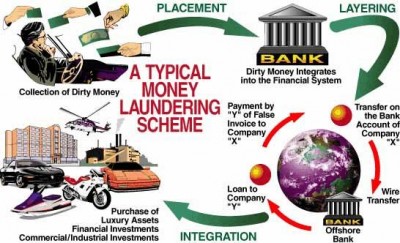

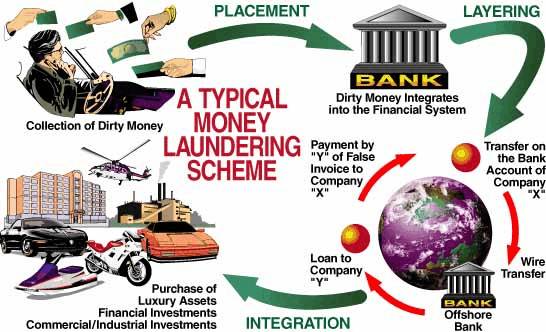

Wrapping your mind around the sums in the report, Drug Cartel Money Laundering Accounted for 85 Percent Of Global Economy For 2012, is not easy.

If the State were truly serious about shutting down the drug trade, putting out of business the major international bank violators would be the test. Money laundering, not the canal, built the Panama City skyline. Do you think that Manuel Noriega might have to answer questions 4 & 5 of the FATCA query? Probably not, his bank accounts must have been seized by his partner, George H. Bush.

FATCA remains an instrument to force repatriation of law-abiding citizen funds, for domestic IRS taxation scrutiny, if they support the Tea Party. So goes, the phony war on money laundering!

LINK TRADUZIONE

SOTTO IL TESTO MACCHERONICAMENTE TRADOTTO

Financial Privacy and the Laundering of Drug Money

By James Hall

Global Research, June 18, 2014

BATR

Region: USA

Theme: Global Economy, Law and Justice, Police State & Civil Rights

Theme: Global Economy, Law and Justice, Police State & Civil Rights

490

38 0

690

38 0

690

The Foreign Account Tax Compliance Act, is the latest government effort to eliminate financial privacy from the international banking system. Already provisioned within the law are reporting requirements and penalties, so the intent of this regulation requisite, seems more intent on closing down foreign bank relations for American citizens.

- FATCA targets tax non-compliance by U.S. taxpayers with foreign accounts

- FATCA focuses on reporting

- By U.S. taxpayers about certain foreign financial accounts and offshore assets

- By foreign financial institutions about financial accounts held by U.S. taxpayers or foreign entities in which U.S. taxpayers hold a substantial ownership interest

- The objective of FATCA is the reporting of foreign financial assets; withholding is the cost of not reporting

As FATCA Comes Online July 1, 2014, most foreign banks will be under the gun to make inquires of their customers.

- Were you born in the USA?

- Do or did you ever have a U.S. Passport?

- Do or did you ever have a U.S. Green Card (Permanent residency status)?

- Do or did you ever live in the United States and, if so, provide all dates of residing in the U.S.?

- Do or did you ever have a physical address in the U.S.?

- Do or did you ever have a U.S. mailing address in your name?

- Do or did you ever have a U.S. mailing address in care of your name?

- Do or did you ever have legal representation in the U.S.?

If you answer yes to any one of the above questions, some banks will immediately close your account and forwarded on the balance to you and other banks sent W-8BEN and/or W-9 IRS forms for completion and mailing back to the bank upon which a possible 30% U.S. tax withholding would be levied upon your accounts.

The underlying drive to discover the actual ownership of enterprises and their fiduciary principals are the focus in the article, FATCA’s crucial sidekick, the hunt for ‘beneficial owner’.

“Beneficial ownership as a policy issue is very multifaceted,” says Joshua Simmons, a Legal Fellow with advocacy group Global Financial Integrity. “It’s much larger than anti-money laundering. It also ties into corruption, fraud, sanctions and tax evasion issues. Now, a lot of the focus on it is being driven by international attention on tax evasion.”

Tax evasion has no greater case in point than the trade in drugs. Yet, efforts to curb money laundering have failed miserably. The account, The destructive effort to combat money laundering, tax evasion and terrorist financing, demonstrates that laws and regulations meant to prevent washing tainted gains, miss their mark.“The most recent global waste of money and life is the “war” on the vague crime of “money-laundering.” The anti-money laundering zealots claim the war is needed to stop global tax evasion, drug dealing and terrorist finance. Despite, again, the hundreds of billions of dollars spent on the effort and the many lives lost, there is scant evidence that tax evasion, drug dealing, or terrorism have been significantly reduced, by anti-money laundering regulations.”

Take the historic grand daddy of banking houses, built upon the drug trade, the notorious Hong Kong and Shanghai Bank. The British firm behind the Chinese Drug trade, the bank that would become HBSC, perfected the Dope, Inc. model, which profited from the Opium Wars. Such experience along with government protection enabled HSBC’s stunning growth in international deposit relationships.

Wrapping your mind around the sums in the report, Drug Cartel Money Laundering Accounted for 85 Percent Of Global Economy For 2012, is not easy.

“According to legal documents for the case filed in 2012, HSBC admitted that it failed to apply legally required money laundering controls to $60 trillion in wire transfers alone, in only a three year period, $670 billion of which came from Mexico. $60 trillion-that is approximately 85 percent the entire world’s GDP in 2012. In a settlement to put an end to the probe into their money laundering activities in late 2012, HSBC agreed to pay a fine of $1.9 billion. While HSBC may have been associated with the largest money laundering operation in U.S. banking history, it is by no means alone.”

Paying large fines that are but mere drops in a bucket of nose candy consignments are just part of the cost of business. No wonder that author, Matt Taibbi says the Outrageous HSBC Settlement Proves the Drug War is a Joke. Reuters contributor, Brett Wolf in Less drug-money traffic at HSBC may mean more risk for other banks in U.S. cites the section of the law violated.“HSBC was vulnerable because it failed to take the steps necessary to know its customers, and because monitoring of banknotes transactions was conducted manually by one or two compliance officers, according to the statement of facts, which is the product of a years-long probe by U.S. law enforcement officials. Furthermore, the bank’s U.S. unit did not appropriately gauge the risks associated with its Mexican counterpart.

The DPA states that HSBC’s compliance lapses violated two Bank Secrecy Act provisions — subsections of Title 31, US Code, Section 5318 — which address inadequate anti-money laundering programs and the failure to conduct proper due diligence in correspondent banking relationships.”

Now proponents of FATCA will claim that this new requirement will put a severe cramp in the automatic wash cycle. How silly, the notion that banksters will cease and desist their laundering machine, when government agencies like the DEA, CBP, ICE, DHS, ATF, and the sure standard bearers, FBI and CIA draw supplementary covert funding from their percentage in the business of trafficking from drug contraband.The DPA states that HSBC’s compliance lapses violated two Bank Secrecy Act provisions — subsections of Title 31, US Code, Section 5318 — which address inadequate anti-money laundering programs and the failure to conduct proper due diligence in correspondent banking relationships.”

If the State were truly serious about shutting down the drug trade, putting out of business the major international bank violators would be the test. Money laundering, not the canal, built the Panama City skyline. Do you think that Manuel Noriega might have to answer questions 4 & 5 of the FATCA query? Probably not, his bank accounts must have been seized by his partner, George H. Bush.

FATCA remains an instrument to force repatriation of law-abiding citizen funds, for domestic IRS taxation scrutiny, if they support the Tea Party. So goes, the phony war on money laundering!

LINK TRADUZIONE

Comment